Working papers

“The Information Content of Stress Test Announcements” with Michele Modugno, December 2023.

“A Static Capital Buffer Is Hard to Beat” with Matthew Canzoneri, Behzad Diba, and Arsenii Mishin, March 2023 — this paper was previously circulated with the title “Optimal Dynamic Capital Requirements and Implementable Capital Buffer Rules.”

“Optimal monetary policy with endogenous financial intermediation” with Jinill Kim, 2019.

Older but not forgotten

“Can macro variables used in stress testing forecast the performance of banks?” with Michelle Welch, 2012.

“Oil Efficiency, Demand, and Prices: a Tale of Ups and Downs” with Martin Bodenstein, 2011.

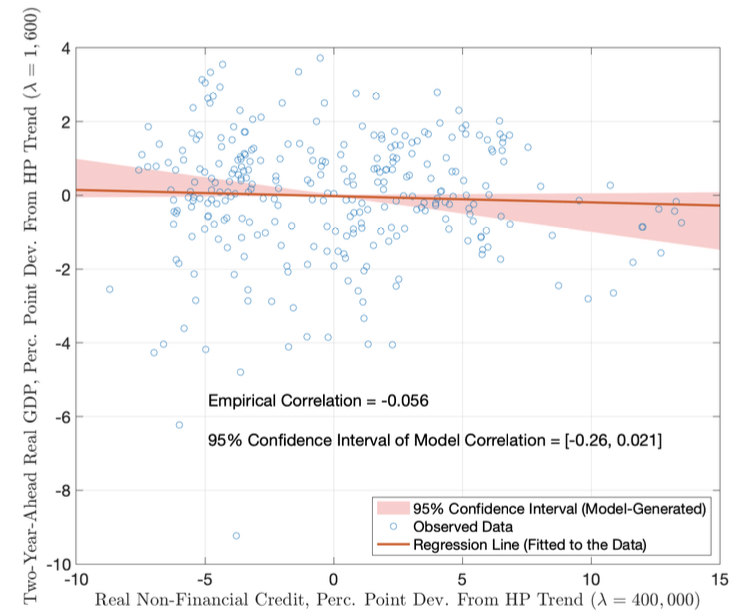

There is a tenuous predictive relationship between the ratio of nonfinancial credit to GDP and GDP two years ahead. Setting bank capital requirements following a simple rule based on the credit-to-GDP ratio is not a good idea in our model even if the model encapsulates a predictive relationship in line with the observed data.

A Static Capital Requirement is Hard to Beat

with Matt Canzoneri, Behzad Diba and Arsenii Mishin — latest version March 2023

Rules that respond to cyclical conditions fail to prevent excessive risk taking, whereas a static capital buffer performs nearly as well as the Ramsey rule.

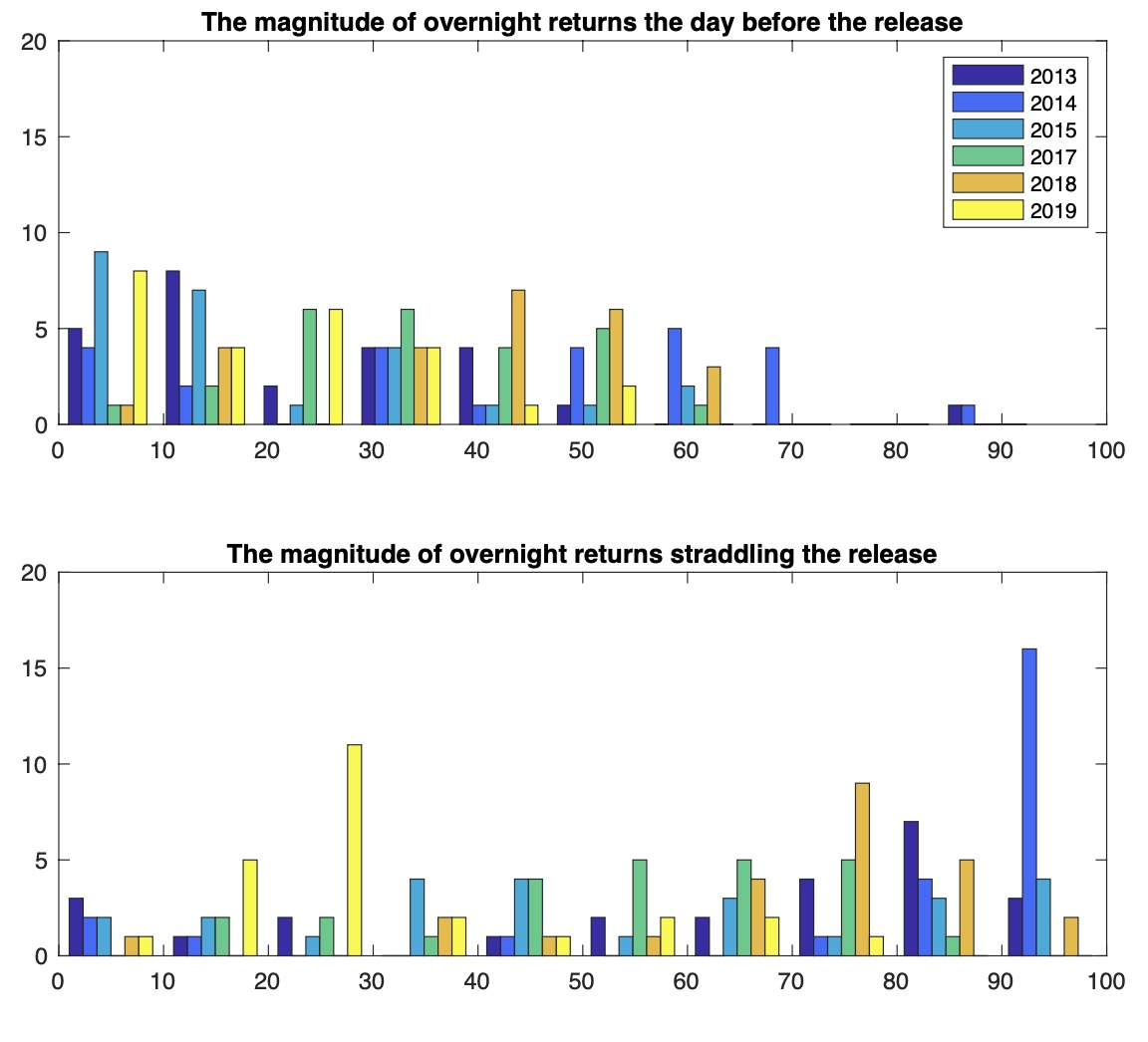

The Information Content of Stress Test Announcements

with Michele Modugno

By examining the reaction of different asset prices, we find evidence that market participants value the stress test announcements not only for the information on possible future capital distributions but also for the signals about bank resilience. These results back the use of stress tests by central banks to inform the broader public about the soundness of the banking system.